Credit Repair Services

Optimizing Your Credit File For A Better Tomorrow

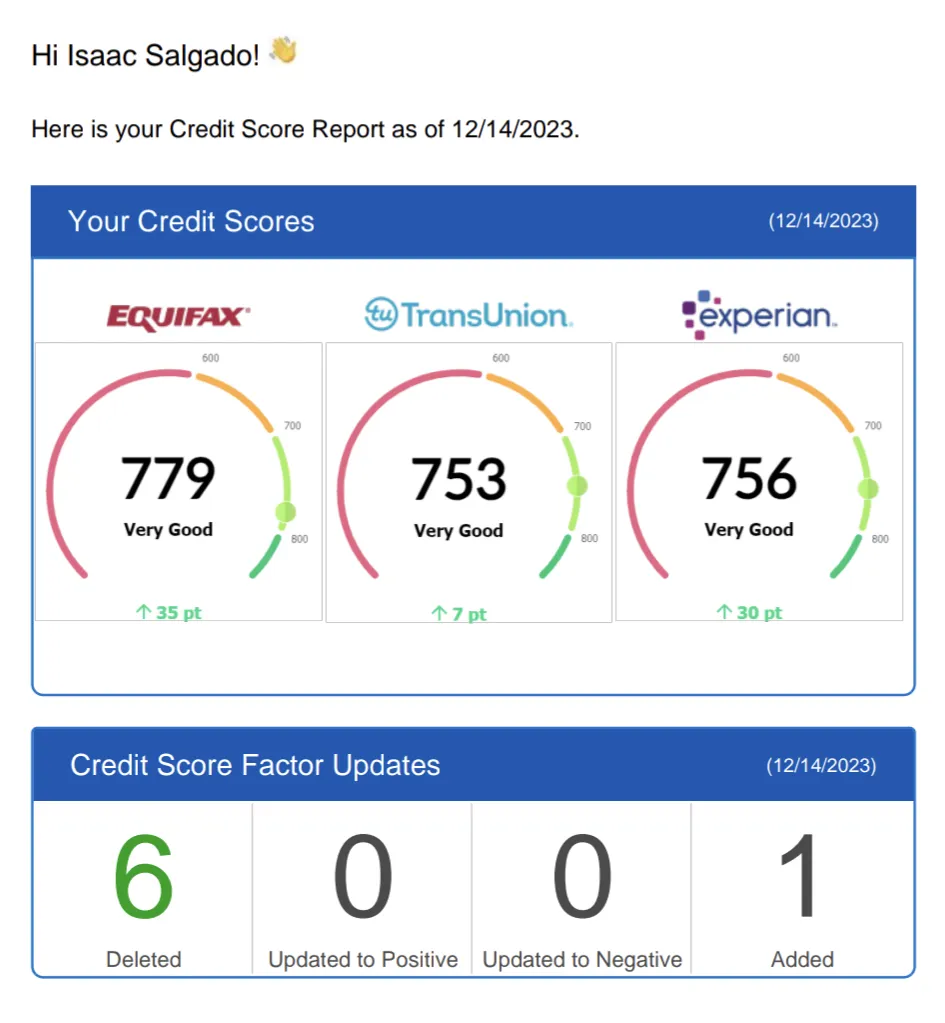

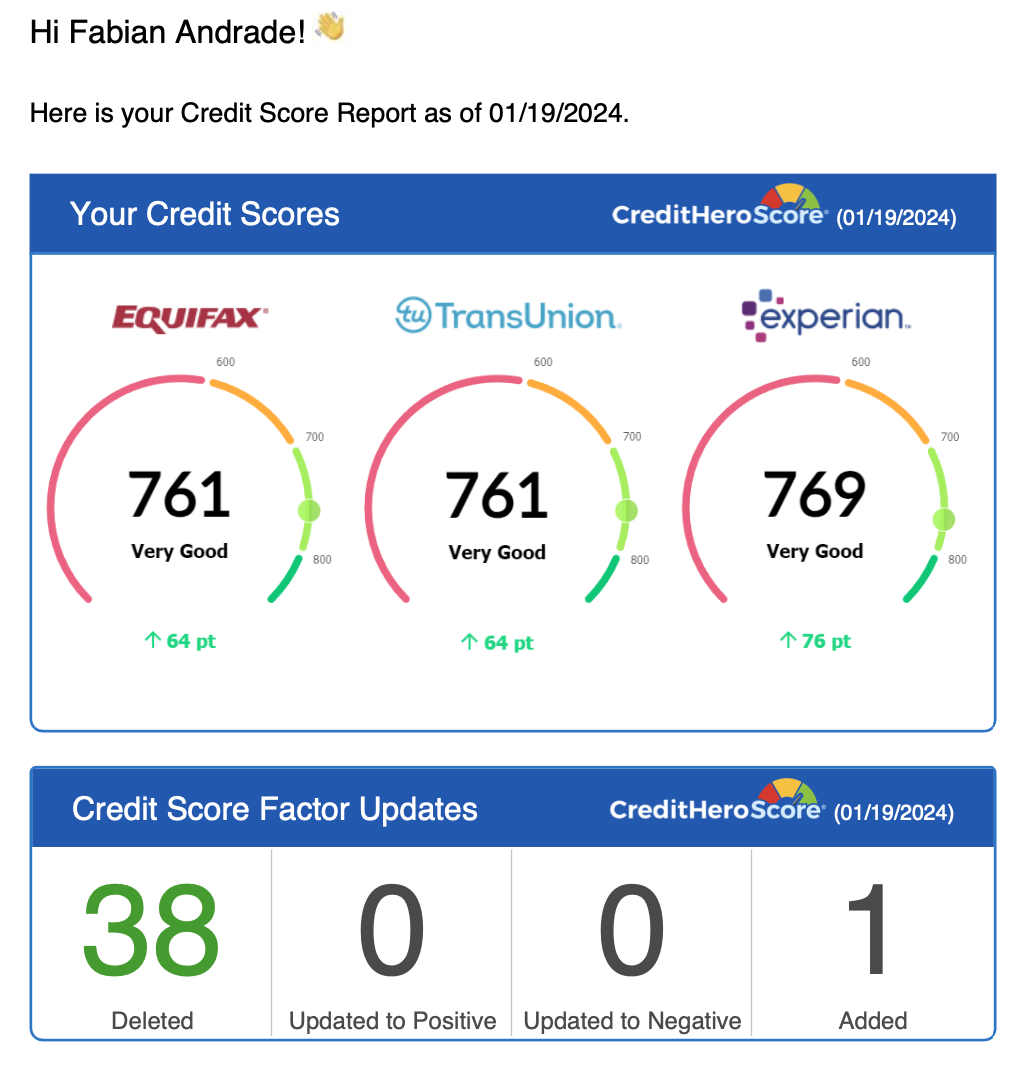

On average, our clients see a 50-165 point increase on their credit score in just 1-6 months! We are confident we can achieve these results for you.

Where Bad Credit Meets

FCRA Section 611

We assist you in identifying errors and inaccuracies on your credit report and actively dispute these with the credit bureaus. Improving your credit score really is that straightforward. With our expertise and diligent approach, we make the process efficient and effective, guiding you towards a better credit future.

+183 Increase

FICO Score at 746

Revolving Credit

This allows the borrower to access a line of credit up to a certain limit as long as the account is open and payments are made on time. Credit cards are a common form of revolving credit.

Open Credit (Charge Accounts)

These are typically for specific purposes and places where the full balance must be paid at the end of each billing cycle. Utility bills and mobile phone service contracts often operate on this basis.

Business Credit

Business credit refers to the ability of a business to borrow money that it can use to purchase products or services based on the trust that payment will be made in the future. Unlike personal credit, which is linked to an individual's financial history, business credit is tied to a business entity. Establishing strong business credit can help a company secure better terms with suppliers, obtain lower interest rates on loans, increase loan and credit limits, and improve the overall image of the company in the eyes of lenders and potential partners.

Installment Credit

This involves loans that are repaid over time with a set number of scheduled payments. Mortgages and auto loans are examples of installment credit.

Secured and Unsecured Credit

Secured credit is backed by collateral, such as a house in a mortgage or a car in an auto loan, providing the lender with assurance that if the borrower defaults on the loan, there is something of value to claim. Unsecured credit does not involve collateral; credit card debt is a common form of unsecured credit.

Business APR Terms

Business credit can often secure better Annual Percentage Rate (APR) terms for loans and credit lines compared to personal credit for several reasons. These favorable conditions can significantly affect a company's cost of borrowing, influencing its financial health and growth potential. Here are some key points on how and why businesses with good credit can access better APR terms

Expanding Possibilities For A Better Tomorrow

At Montx Credit, we understand that better credit opens up new possibilities. Our comprehensive credit repair services are designed to help you achieve financial freedom and stability. With our 100-day guarantee and innovative tools like the New Credit Tracker, we empower you to take control of your financial future. Experience the benefits of improved credit and unlock new opportunities that were once out of reach.

100-Day Guarantee: Confidence in our services is paramount, so we offer a 100-day guarantee to ensure satisfaction with the progress of your credit repair journey.

New Credit Tracker: Utilize our state-of-the-art tool that provides real-time updates and insights into your credit score improvements, helping you stay informed every step of the way.

Enhanced Financial Opportunities: Better credit can open the door to lower interest rates, higher loan approvals, and better terms on financing options.

Empowerment Through Education: We provide resources and guidance to help you understand your credit and manage it effectively, fostering long-term financial health.

Remove any of these and Increase your score by 30-60 Points

Hard Inquiry

Collections Debt Collectors

Late Payments

Repossessions

Bankruptcy

Identity Theft

We see results within the first 1 to 2 months in our program

Expanding Possibilities For A Better Tomorrow With Business Credit

Access to Better Financing Options

Lower Interest Rates and Better Terms: Businesses with strong credit histories typically qualify for loans and credit lines with lower interest rates and more favorable repayment terms. This can significantly reduce the cost of borrowing, making it easier for businesses to manage cash flow and finance expansion efforts or operational needs efficiently.

Higher Credit Limits: A solid business credit profile often leads to higher credit limits from lenders and suppliers. This increased borrowing capacity allows businesses to pursue larger projects, bulk inventory purchases, or invest in growth opportunities without straining their operational funds.

Separation of Personal and Business Finances

Risk Management: By building business credit, entrepreneurs can separate their personal finances from their business dealings. This separation is crucial for personal asset protection. If the business encounters financial difficulties, the owner's personal credit and assets are less likely to be at risk.

Professional Credibility: Establishing business credit enhances a company's credibility with lenders, suppliers, and potential partners. A strong business credit report signals to other businesses and financial institutions that your company is a reliable and low-risk entity with which to do business. This professional reputation can open doors to new partnerships, contracts, and business opportunities.

Chris, I just wanted to say thank you !!! Today I received this notification that a repo has been removed and so was the balance from my credit report it boosted my credit up 33 points Im very glad I went thru with the decision to fix my credit thru Montx!!! This is a blessing to my family and another step closer to be able to refinance our house for a lower rate. Thank you Chris!!! God Bless!!

Eric A.

Hi Chris 👋🏼I got the Property Manager position🙏🏽🎉 Thank you Jesus 🙌🏼I am thinking about getting the Amazon visa that you suggested but also a Costco credit card since I will probably be purchasing TV or furniture from there as well. what do you think? And is there any tricks to getting bigger credit line??Thanks in advance.

Marissa T.